Cordell Eminent Scholar Jay Ritter provides his expertise on unprofitable traditional IPOs delivering lower first-day returns in 2021. Read the full story from the Wall Street Journal.

Finance Articles: page 25

The SEC’s concern about unicorns misses the point

Research data from Cordell Eminent Scholar Jay Ritter informs this opinion piece that advises instead of increased oversight of large private companies, the agency should make it easier for startups to go public. Read the full piece from Bloomberg. [Subscription required.]

Of course GameStop is doing NFTs

Cordell Eminent Scholar Jay Ritter shares data for this opinion piece from Matt Levine, who advises public companies that are in a position to attract meme-driven retail investors to “lean into meme stuff.” Read more in this piece from Bloomberg. [Subscription

Warrington professor awarded for distinguished service in premier real estate finance association

GAINESVILLE, Fla. – Robert A. Connolly, Adjunct Professor of Finance and Real Estate, is the 2022 recipient of the American Real Estate and Urban Economics Association (AREUEA) George Bloom Award. Connolly is the third member of Warrington’s faculty to receive

Investors lose ground in fight against supervoting shares

A record 32% of US companies went public with dual-class structure last year, analysis from Cordell Eminent Scholar Jay Ritter shows. See more of Ritter’s insights in this story from Financial Times. (Subscription required.)

The SPAC boom hasn’t guaranteed winners

“For the 262 SPAC mergers that were completed during 2020 and 2021, the average stock price on Dec. 31, 2021, was $8.70, considerably below the average price of more than $10 per share at which the stocks traded at the

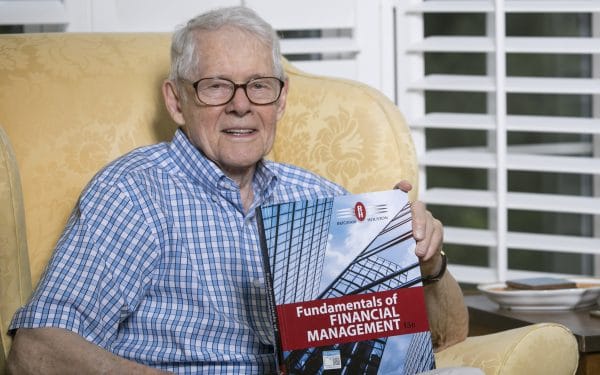

3 top finance textbooks share the same home – UF’s Warrington College of Business

What do some of the world’s leading finance textbooks have in common? Besides critical lessons on topics ranging from financial management to investments to real estate valuation and a majority of the market share on academic finance literature, these textbooks

2021 Is in the Record Books: A Year of Memes, Crypto, and Stock All-Time Highs

Insights from Cordell Eminent Scholar Jay Ritter inform this story recapping the 2021 markets, including the record $118 billion in gross proceeds from operating company initial public offerings. Read more in this story from Barron’s.

A Booming Startup Market Prompts an Investment Rush for Ever-Younger Companies

Research data from Cordell Eminent Scholar Jay Ritter informs this story about how investors in 2021 pumped a record $93 billion into early-stage U.S. startups through Dec. 15, triple the amount from five years before. Read more insights about the 2021

A Lavish Tax Dodge for the Ultrawealthy Is Easily Multiplied

Cordell Eminent Scholar Jay Ritter shares insights in this story about a 1990s-era tax break, once aimed at small businesses, that has become a popular way for Silicon Valley founders and investors to avoid taxes on their investment profits. Read