Market speculators get an edge through finance professor’s new book

Assistant Professor of Finance publishes book on using Artificial Intelligence to predict market changes.

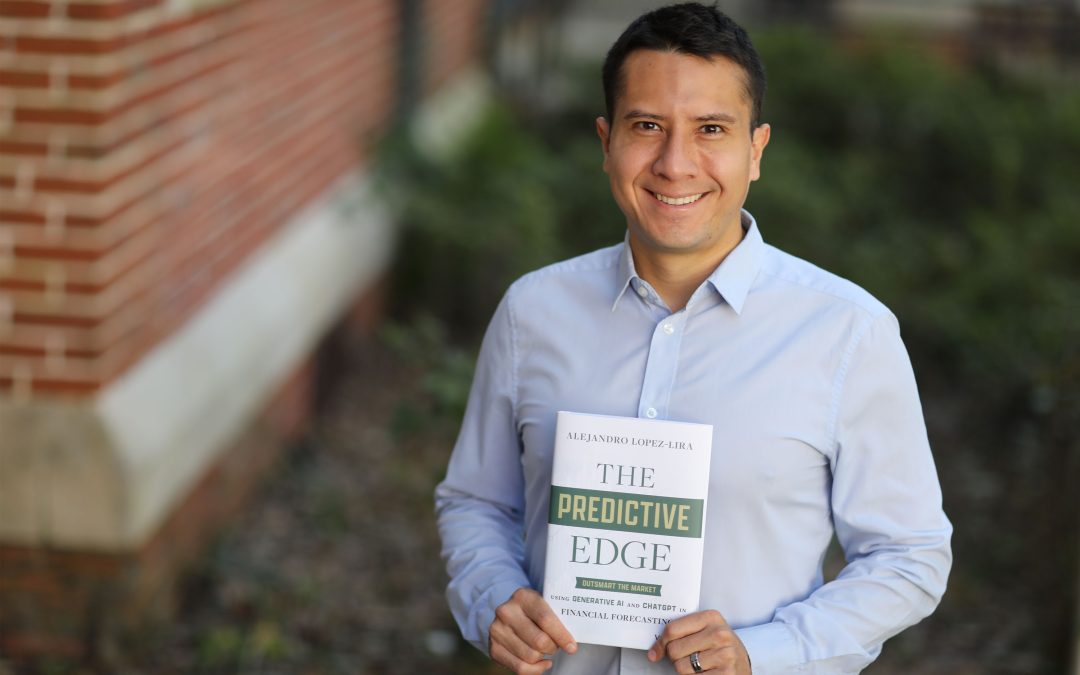

With constant developments in the field of finance, it can be tricky to predict what’s coming next. Fortunately, Alejandro Lopez-Lira, assistant professor at the University of Florida Warrington College of Business, offers speculators an edge through his recently published book, The Predictive Edge: Outsmart the Market using Generative AI and ChatGPT in Financial Forecasting. Artificial Intelligence like ChatGPT and other Large Language Models (LLMs), he reveals, can be used to create trading strategies and discover future trends in artificial intelligence and finance.

Read on to learn about Lopez-Lira’s book and how it can help readers get ahead.

Q: What are the key points of your book?

Lopez-Lira: “My book explores how generative technologies like ChatGPT can be applied to financial applications. Concretely, it gives an overview of AI, finance, AI in finance and a step-by-step guide in implementing finance systems that use tools like ChatGPT, along with its limitations and future.”

Q: Why is this book useful for readers?

Lopez-Lira: “This book is helpful for experts looking for the latest edge and for nonexperts trying to learn about the future of finance. They will understand how ChatGPT will impact the future of finance and its application in personal finance and professional products. The book assumes no previous knowledge of AI or finance, so by reading it they can be at the frontier of knowledge. For finance professionals it is a must, since AI will dominate the future of finance.

“AI is already transforming finance through applications in trading, fraud detection and financial advising. It processes data rapidly, identifying patterns that humans may overlook, potentially increasing efficiency across the financial sector. This trend will only continue. However, AI faces challenges, including data quality issues, lack of transparency in decision-making and regulatory concerns. AI still requires human oversight to address its limitations.”

Q: What inspired you to delve into the intersection of AI and financial forecasting?

Lopez-Lira: “As soon as ChatGPT came out, I was completely surprised by its capabilities and became obsessed [with] how to use it in finance tasks. I soon wrote a research paper with Yuehua Tang from UF, highlighting ChatGPT’s potential to forecast stock price movements that generated a lot of media attention. Soon after, I was invited to write the book.

“I first became interested in finance and AI back in 2017 during my PhD at Wharton. I wanted to understand how AI could give us a better understanding of the risks in the economy by looking at the annual reports of companies and the risks they documented.”

Q: Which findings from your book excite you the most?

Lopez-Lira: “The most surprising finding is how good AI is at tasks it was not designed to be good at. These models are not trained to be good at finance, yet they keep getting better and better just by virtue of being larger.”

Q: Tell us about your writing process.

Lopez-Lira: “The book is grounded in my previous academic research so most of the research occurred beforehand. A big part of the work was translating boring research language into interesting literature for a wide audience.

“I tried to write as long as I could every day. Sometimes I would do up to 16 hours per day. I have a laptop lap tray and a second screen in my laptop that allows me to work anywhere.”

Q: In the preface of your book, you mention that it was inspired by an academic paper you wrote in 2023 that has since been downloaded over 60,000 times. What feedback have you received so far about your book?

Lopez-Lira: “I want more people to disagree with my views on the book, haha. Most people I’ve talked to have received the book very well. Everyone is intrigued about AI’s capabilities, and we have updated the research to forecast more about the future impact.”

Q: How has your book impacted your work at the Warrington College of Business?

Lopez-Lira: “I incorporate the use of ChatGPT and other large language models actively in class. We use them to code, analyze data and illustrate statistical concepts. However, it is very useful to students to know how these models work so they can know when to apply them. One usual activity was forming groups and trying to come up with the correct answer for difficult finance problems with the help of ChatGPT.”