The abrupt failures of Silicon Valley Bank and Signature Bank and subsequent concerns about the stability of other banks have reignited a fierce debate among lawmakers, the financial industry, the Biden administration and former government officials about an array of

Finance Articles: page 18

Finance professor honored for outstanding stock market research

Baolian Wang, Bank of America Associate Professor of Finance, is the second prize recipient of the Roger F. Murray prize. Every year, the Institute for Quantitative Research in Finance, or Q Group, awards three prizes to individuals who present outstanding

ChatGPT may be able to predict stock movements, finance professors show

In a new working paper, Assistant Professor Alejandro Lopez-Lira and Emerson-Merrill Lynch Associate Professor Yuehua Tang find that large language models may be useful when forecasting stock prices. They used ChatGPT to parse news headlines for whether they’re good or

Mutual funds generate better returns with thematic investing

GAINESVILLE, Fla. – Risky, trendy, volatile. These are just a few recent descriptions of thematic investing, an emergent investment strategy that focuses on using research to identify companies relevant to themes or trends created by the impact of economic, technological

Corporate Partnerships: Evercore

When Saul D. Goodman reconnected with his debt capital markets professor in 2006, he wanted to increase his involvement with his alma mater. It had been 17 years since Goodman graduated from the University of Florida and he wanted to

Higher stakes lead to worse stock performance, research finds

GAINESVILLE, Fla. – Imagine you are walking down the street, and someone stops you to ask this question: You bought a stock at $30 per share. Now, the stock’s price is $15. Under which scenario are you more likely to

Dispirited homebuyers show why Fed’s unprecedented fight against inflation is beginning to succeed

I’ve studied finance and financial markets since the 1970s, and I have never seen the Federal Reserve’s monetary policy get such prominent news coverage as it has this past year. And with good reason. What the Fed does has profound

Looking for stock investment tips? Use social media selectively

GAINESVILLE, Fla. – Savvy investors and news buffs will recall the early days of 2021 when GameStop’s market value increased from about $2 billion to over $24 billion in just a few days. The significant gains stemmed from individual investors,

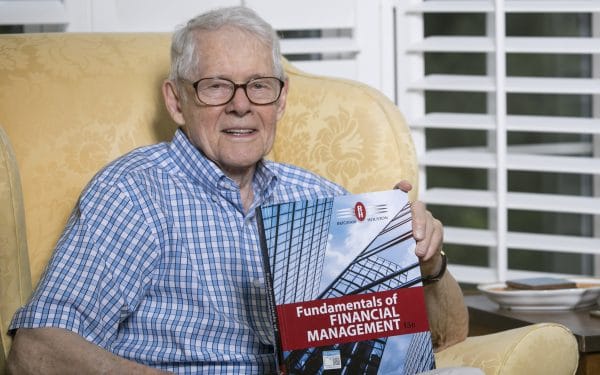

3 top finance textbooks share the same home – UF’s Warrington College of Business

What do some of the world’s leading finance textbooks have in common? Besides critical lessons on topics ranging from financial management to investments to real estate valuation and a majority of the market share on academic finance literature, these textbooks

New program prepares students for careers in wealth management

This fall, students at the Warrington College of Business and across the University of Florida will have the opportunity to hone their wealth management skills thanks to a new program dedicated to the subject. Warrington’s wealth management program is designed