Widely misunderstood, blockchain technology and cryptoassets are often wrongly associated with anarchy and upheaval, explains Associate Professor Fahad Saleh in this column from the Tampa Bay Times.

Finance Articles: page 8

ABC News | Tesla board members, executive sell off over $100 million of stock in recent weeks

As Tesla stock has fallen in recent weeks, members of the board and an executive at Elon Musk’s company have been selling off millions of dollars in stock, according to filings with the U.S. Securities and Exchange Commission. Together, four top

Mind Matters | Today’s startups are doing much worse than those of the past

The percentage of startups profitable at IPO time has steadily declined since the 1980s and most valuable ones take longer to become profitable, according to insights from Jay Ritter. Read more in this story from Mind Matters.

The Chronicle of Higher Education | Yes, the U. of Phoenix sale is still stalled

The University of Phoenix, once the premier for-profit institution in the country, is taking advantage of its ability to court other options as an acquisition deal with a University of Idaho affiliate inches toward a two-year stall. Jay Ritter shares insights on

Morningstar | You might think industry growth drives stock returns. Here’s why you’d be wrong

Investors, take note: Abnormal growth in earnings is neither persistent nor predictable. Research from Jay Ritter informs this story from Morningstar.

Finbold | ChatGPT picks 3 safe haven stocks to buy for 2025

GPT Portfolio, a community project run alongside Alejandro Lopez-Lira, a professor of finance from the University of Florida, consists of 15 assets — 10 stocks and 5 sector-specific exchange-traded funds (ETFs). The portfolio holds the assets for one month — after

Finance and Fashion

One garage sale became a turning point for Lauren Kurtz (BSBA Finance ’27). In late 2019, her family sold a variety of items out of their garage. At the time, Kurtz thought it might’ve been easier to list things online.

Bloomberg | Venture Global flop swiftly wipes out $39 billion after IPO

The list of companies that have flopped out of the gate when entering public markets has a new king: Venture Global Inc. Shares of the liquefied natural gas exporter have cratered more than 60% since going public, erasing $39 billion in

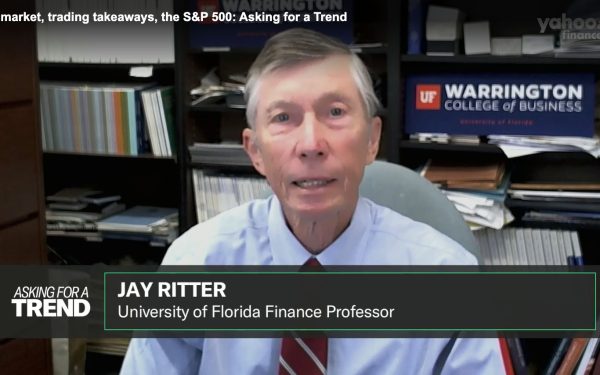

Yahoo! Finance Asking for a Trend | IPO market, trading takeaways, the S&P 500

As Tuesday’s trading winds down and transitions into extended hours, Josh Lipton looks back on the day’s top market themes on Asking for a Trend. University of Florida Finance Professor Jay Ritter breaks down current forecasts for the IPO market in

Investor’s Business Daily | IPO Market Slump Drags On As Unicorns Multiply. Why There’s Hope For More IPOs In 2025.

The IPO market entered 2025 with optimism that IPO stocks can break out of a three-year slump. And some buzzy unicorn companies are busy readying offerings. Cordell Eminent Scholar Jay Ritter shares his insight on IPOs in this story from