Last year, we saw continued improvement in the initial public offering (IPO) market, explains Nasdaq Chief Economist Phil Mackintosh. There were more IPOs, more special purpose acquisition companies (SPACs), and IPOs raised more money than in both 2022 and 2023.

Finance Articles: page 9

The Independent Florida Alligator | ‘They’re playing with real money’: Gamified apps hook young investors

Anoop Savio has hit it big, but he’s also suffered crushing blows. One swipe, and the 21-year-old UF finance master’s student could snag a few shares of AMC. Another swipe, and he’d sell some Dogecoin, a cryptocurrency token. In a

MSF graduate comes full circle as competition judge

The Gator Student Investment Fund and Financial Professional Development Program hosted the Florida Investment Conference in early February. Student teams across the nation submitted stock pitches and 23 teams were selected to attend the in-person event on the UF Warrington

The Economic Times | McKinsey partners question China presence as US tensions mount

McKinsey & Co. partners have been questioning the consulting giant’s presence in China, worried that doing business there may not be worth the risks given the Asian superpower’s increasingly volatile relationship with the U.S. Cordell Eminent Scholar Jay Ritter shares

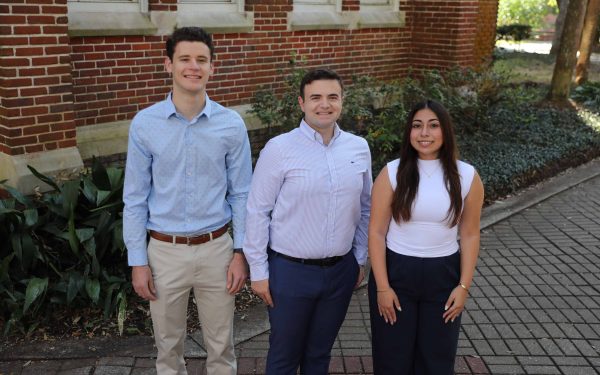

Unlocking potential: the impact of student organizations on Business Gators

At the Warrington College of Business, there are over 40 student organizations for our nearly 8,000 Business Gators to get involved with to learn, network and gain experience outside the classroom. Cassandra Green, Peter Angelo and James Walter are

Honoring the memory of a life-altering mentor

Some things are clearer in hindsight, but fifty years after graduating from the University of Florida with his doctorate in finance, Dr. Stewart Brown is still mystified by how he got to where he is today. When Brown enrolled at

The Independent Florida Alligator | Local businesses bounce back as students return from break

The annual winter exodus of students causes problems for small business owners. Clinical Professor & Richardson Fellow Brian Gendreau comments on how businesses adapt to less customers in this story from The Independent Florida Alligator.

USA Today | Trump Media shares surge one week ahead of presidential inauguration

Shares for the company behind Trump’s social media platform Truth Social ended the day up 21.5% at $42.91. It was the company’s largest single-day jump on the Nasdaq since Trump won the presidential election in November. Shares have been volatile since

Reuters Breakingviews | How private share sales could kill the tech IPO

Databricks, Stripe and Elon Musk’s $350B SpaceX facilitated large exits by insiders without a float. There’s a growing pool of patient capital targeting mature startups. The bigger the trend gets, the more likely it is that profitable unicorns can stay

MarketWatch | Analysts embrace ServiceTitan’s market-share potential in parade of buy ratings

The software maker for blue-collar businesses, which recently went public, draws ‘buy’ or ‘overweight’ ratings from at least six analysts. ServiceTitan (TTAN) went public at $71 a share on Dec. 12, and has seen its stock hit a high of