California has been generating the most initial public offerings of any US state every year since 2003. That streak could end this year unless the Golden State picks up the pace. California’s change of fortune is explained largely by the

Jay Ritter Articles: page 15

SPAC Sponsors Were Winners Even on Losers

Money managers who oversaw blank-check companies kept making profits even in the face of significant losses to stock investors. “There is no question that the sponsors had great returns at the same time that public market investors had very negative

The IPO market went from ‘boom to bust’ in 2022. Here’s what’s driving the massive slowdown.

From the best of times, to the worst of times: The market for initial public offerings has fallen off a cliff in 2022. Investors faced with high inflation and rising interest rates have ditched high-flying growth stocks and turned to safer,

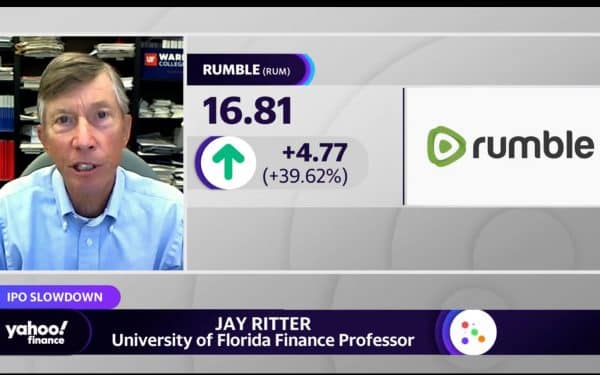

Trump-tied Truth Social’s ‘regulatory trouble’ may benefit Rumble’s IPO: Expert

IPO expert and Cordell Eminent Scholar Jay Ritter joins Yahoo! Finance Live to discuss the SPAC deal for the Peter Thiel-backed company Rumble, which has started trading on the stock exchange, and also weighs in on the Porsche and Instacart

Apple is now the market’s most shorted stock. If Tesla is an example, that’s bullish.

Apple shareholders need not worry that it’s the most-shorted U.S. stock. A report from short-seller analytics firm S3 Partners said that, after 864 days in which Tesla TSLA, 1.53% was at the top of this list, Apple AAPL, 0.96% has acquired

Corebridge IPO shows appeal of crowd support for companies

Corebridge, the life and asset management business of insurance group AIG, went public this week with the help of 43 different banks, the second-highest number of managing underwriters for a US listing on record, according to data collected by the

SPAC market hits a wall as issuance dries up and valuation bubble bursts

The SPAC boom is officially a thing of the past. “I think that was a once-in-a-lifetime experience just like during the internet bubble,” said Cordell Eminent Scholar Jay Ritter. “A year ago, the whole market was overpaying and now we

I’ve Never Been an Impulse Buyer—Until Now

Sometimes, says Cordell Eminent Scholar Jay Ritter, rather than cutting back on big purchases during periods of high inflation, we actually end up spending more. In a way, he says, we’re trying to “lock in” prices now on these long-desired

What Investors Need to Know About AMC’s APE Units: A Stock ‘Split on Steroids’

AMC outlined plans this month to issue a special dividend, sending its shares soaring and stoking enthusiasm among the company’s passionate base of individual investors. Cordell Eminent Scholar Jay Ritter shares his expert opinion on AMC’s plan. Read more in

Demise of largest SPAC ever comes amid market and regulatory headwinds

As an IPO during the go-go year of 2020 for SPACs, Ackman’s Pershing Square Tontine Holdings ran up against a two-year deal deadline facing many SPACs. Blank check companies, or SPACs, typically have 24-months to buy a company or they