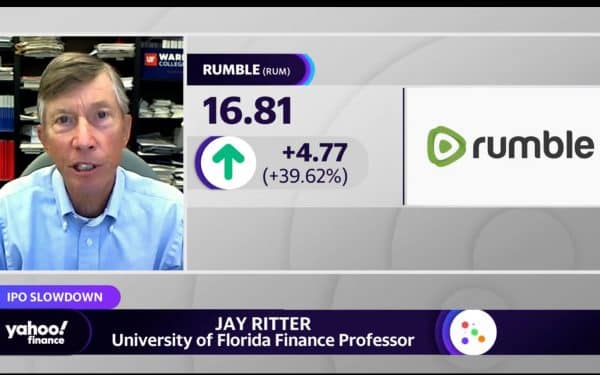

IPO expert and Cordell Eminent Scholar Jay Ritter joins Yahoo! Finance Live to discuss the SPAC deal for the Peter Thiel-backed company Rumble, which has started trading on the stock exchange, and also weighs in on the Porsche and Instacart

Jay Ritter Articles: page 20

Apple is now the market’s most shorted stock. If Tesla is an example, that’s bullish.

Apple shareholders need not worry that it’s the most-shorted U.S. stock. A report from short-seller analytics firm S3 Partners said that, after 864 days in which Tesla TSLA, 1.53% was at the top of this list, Apple AAPL, 0.96% has acquired

Corebridge IPO shows appeal of crowd support for companies

Corebridge, the life and asset management business of insurance group AIG, went public this week with the help of 43 different banks, the second-highest number of managing underwriters for a US listing on record, according to data collected by the

SPAC market hits a wall as issuance dries up and valuation bubble bursts

The SPAC boom is officially a thing of the past. “I think that was a once-in-a-lifetime experience just like during the internet bubble,” said Cordell Eminent Scholar Jay Ritter. “A year ago, the whole market was overpaying and now we

I’ve Never Been an Impulse Buyer—Until Now

Sometimes, says Cordell Eminent Scholar Jay Ritter, rather than cutting back on big purchases during periods of high inflation, we actually end up spending more. In a way, he says, we’re trying to “lock in” prices now on these long-desired

What Investors Need to Know About AMC’s APE Units: A Stock ‘Split on Steroids’

AMC outlined plans this month to issue a special dividend, sending its shares soaring and stoking enthusiasm among the company’s passionate base of individual investors. Cordell Eminent Scholar Jay Ritter shares his expert opinion on AMC’s plan. Read more in

Demise of largest SPAC ever comes amid market and regulatory headwinds

As an IPO during the go-go year of 2020 for SPACs, Ackman’s Pershing Square Tontine Holdings ran up against a two-year deal deadline facing many SPACs. Blank check companies, or SPACs, typically have 24-months to buy a company or they

The Case For Going Public Too Early

Currently, virtually every venture-funded company that went public in 2020 or 2021 is trading at a fraction of its former high. The hardest hit have largely been those who took the SPAC route to market, many of whom are now

Enjoy Technology, led by ex-Apple and JC Penney executive Johnson, files bankruptcy

Insights from Cordell Eminent Scholar Jay Ritter inform this story about Enjoy Technology Inc, a Silicon Valley retailer led by former Apple Inc and JC Penney Co executive Ron Johnson, which filed for bankruptcy protection on Thursday, fewer than nine

US IPO drought to continue

Cordell Eminent Scholar Jay Ritter contributes his insights to this story about how US ECM bankers are facing the slowest market for IPOs in more than six years with few obvious signs that conditions are about to take a turn