Warrington in the News Articles: page 15

It’s no secret that Warrington faculty are internationally renowned for their innovative research. The media looks to our scholars for insights and impactful news. See below where our faculty are featured in the news.

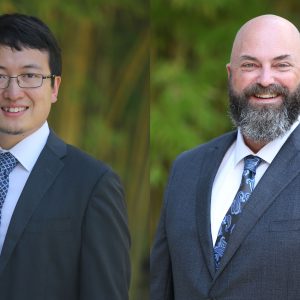

Low-cost retailers, much like their most frequent customers, have fallen on hard times. Assistant Professor of Marketing Tianxin Zou and David F. Miller Retail Center Director Joel Davis share insights for this story.

Discount stores dot the city. Does Gainesville still need them?

The Independent Florida Alligator

“I continue to be surprised how there is not more IPO activity happening now. The stock market is hitting record highs,” Cordell Eminent Scholar Jay Ritter told Observer.

The Stock Market Is Roaring Back. Why Isn’t the IPO Market?

Observer

Robert Knechel, Frederick E. Fisher Eminent Scholar and Director of the International Accounting and Auditing Center, shares his insights into the financial reporting ecosystem as well as the current challenges the audit profession is facing.

Robert Knechel | Corporate Failures and the Challenges Facing the Audit Profession

Egyptian Online Seminars in Business, Accounting and Economics | Mohamed Elsalkh

Presidents can move entire markets with a single sentence. Donald Trump, a former president, sent a single stock soaring with just three words: “I’m not selling,” he pronounced at a press conference on Sept. 13, when asked whether he would offload the millions of shares he owns in his social media company. Buoyed by this declaration of faith from its largest shareholder, the stock shot up 27% to $20.76, before closing the day at $17.97. Cordell Eminent Scholar Jay Ritter shares his insights.

Trump Media lockup deadline leaves Trump with a choice: trigger a fire sale or hold a meme stock

Fortune

Incivility at work makes us more stressed out and our performance suffers. When left unchecked, it can contribute to a toxic work culture. Daniel Kim, Klodiana Lanaj and Joel Koopman write that employees who act rudely tend to feel guilty and vent at home in the evening. On the positive side, guilt also motivates them towards reparation, focusing harder on their tasks and avoiding breaking social workplace norms.

Workplace incivility can cost you your peace of mind

LSE Business Review

IPOs are far more likely to underperform the market than deliver spectacular gains. Research data from Cordell Eminent Scholar Jay Ritter informs this story about why investors shouldn’t get excited.

Investing in IPOs: a good idea or a risky affair?

MoneyWeek

The company behind the Truth Social platform is worth more than $3 billion on Wall Street, and Trump owns more than half of it. So far, Trump and other insiders in the company known as TMTG have been unable to cash in because a “lock-up agreement” has prevented them from selling any of their shares since TMTG began trading publicly in March.

Trump’s lock-up deal looks set to expire later this week. But if he sells, Trump risks sending a negative signal to other shareholders and prompting them to dump their shares. For now, Trump says he’s not selling.

Cordell Eminent Scholar Jay Ritter shares more about what the end of the lock-up could mean and what Truth Social actually does.

Trump will soon be able to sell shares in Truth Social’s parent company. What’s at stake?

AP

Shares of Trump Media, the company behind Donald Trump’s social media platform, Truth Social, surged Friday after the former president said he had no plans to sell his stake, ending weeks of speculation and calming investor fears. Cordell Eminent Scholar Jay Ritter shares his insights on the stock.

DJT shares pop after Donald Trump says 'I am not selling' Trump Media stake

USA TodayTrump media shares soar after Trump says 'I'm not selling'

Bloomberg

Offerings registered with the SEC in the past weeks have bolstered the exit route, as the market for new listings accelerates. Cordell Eminent Scholar Jay Ritter shares his insights.

IPOs by Private Equity-Backed Companies Suggest a Market Revival Is Brewing

The Wall Street Journal

Cordell Eminent Scholar Jay Ritter shares his insights on the record-low closing of the shares of Trump Media & Technology Group, the parent company to former president Donald Trump’s social media platform Truth Social, following Tuesday night’s presidential debate.