Warrington in the News Articles: page 20

It’s no secret that Warrington faculty are internationally renowned for their innovative research. The media looks to our scholars for insights and impactful news. See below where our faculty are featured in the news.

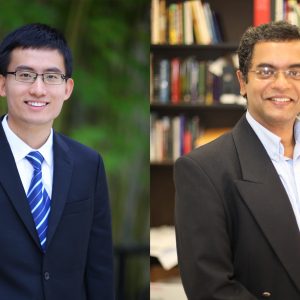

New research from PricewaterhouseCoopers Professor Liangfei Qiu and Robert B. Carter Professor Praveen Pathak highlights that despite the fears of regulators and skittish investors, clear and accurate signals of cryptocurrency quality may be hidden in plain sight. Forthcoming in Journal of Management Information Systems, the recent paper is the first to examine whether the intensity of developer engagement with a cryptocurrency could indeed be related to its quality.

Cryptocurrency’s surprising transparency advantage

George Mason University Costello College of Business

It’s not uncommon for managers to continue thinking about their job, even after the official workday is over. But new research from Martin L. Schaffel Professor Klodiana Lanaj and alumna Remy Jennings (Ph.D. ’22) shows that this tendency may not be beneficial, particularly for people new to a leadership role.

Want to Be a Better Leader? Stop Thinking About Work After Hours

Harvard Business Review

David F. Miller Retail Center Executive Director and Clinical Professor Joel Davis comments on the possible economic reasons why Costco hasn’t opened a location in Gainesville.

A Costco desert: Gainesville residents pine for Kirkland Signature

The Alligator

Cordell Eminent Scholar Jay Ritter lends his SPAC insights to this story about LifeWallet, the health-insurance claims company founded by lawyer John H. Ruiz, a top financial booster of University of Miami athletics, which faces another legal challenge after Miami healthcare provider Cano Health filed a lawsuit last week saying that Ruiz’s company owes it nearly $67 million. While their stocks traded for 45 cents and 12 cents per share, respectively, at market close on Tuesday, Cano and LifeWallet were among the highest-profile Florida companies in recent years to go public through mergers with special purpose acquisition companies (SPAC).

In latest troubles, top UM athletics booster John Ruiz faces $67 million lawsuit Read more at: https://www.miamiherald.com/sports/college/acc/university-of-miami/article278253023.html#storylink=cpy

The Miami Herald

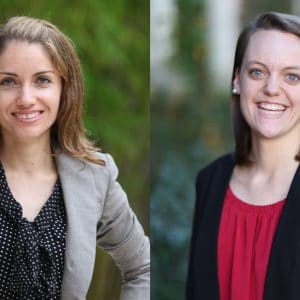

Assistant Professor Alejandro Lopez-Lira and Emerson-Merrill Lynch Associate Professor Yuehua Tang find that large language models may be useful when forecasting stock prices. They used ChatGPT to parse news headlines for whether they’re good or bad for a stock, and found that ChatGPT’s ability to predict the direction of the next day’s returns were much better than random.

ChatGPT may be able to predict stock movements, finance professors show

CNBC

Jack Kramer Term Associate Professor Michael Mayberry and Assistant Professor Scott Rane are co-authors of a new paper that finds that the risk-incentivizing component of option compensation is positively associated with conforming tax avoidance, while value-creation component of option compensation is negatively associated with conforming tax avoidance.

Executive compensation incentives influence firms' conforming tax avoidance, research finds

University of Kansas News

New research from alumnus Anurag Garg (Ph.D. ’22) and Warrington’s Emre Demirezen, Kutsal Dogan and Kenny Cheng finds that despite the proliferation of platforms such as Amazon Alexa and Google Home, customers do not perceive them as valuable unless experiencing adequate levels of quality and security. This research studies the financial viability of the platform provider (like Amazon’s Alexa) and app developers, finding collaboration between these two sides plays a significant role in the profitability of all parties.

Internet of Things financial sustainability depends on quality and security

University of Kansas News

Where, when and how we work may never return to pre-pandemic norms. Artificial intelligence and demographic shifts will reshape our careers. And we’ll need to tend to ourselves and each other to ward off burnout and grow as workers and leaders. That’s what we heard when we asked for advice and predictions from University of Florida management faculty — the country’s top management department in publications per capita in a 2021 Texas A&M/University of Georgia research productivity ranking.

The faculty’s shift toward envisioning the long-term impact of pandemic-era disruptions is a natural extension of their research, says Warrington College of Business Dean Saby Mitra, who calls their work “very applicable to people’s daily lives.”