Warrington in the News Articles: page 25

It’s no secret that Warrington faculty are internationally renowned for their innovative research. The media looks to our scholars for insights and impactful news. See below where our faculty are featured in the news.

Money managers who oversaw blank-check companies kept making profits even in the face of significant losses to stock investors.

“There is no question that the sponsors had great returns at the same time that public market investors had very negative returns,” said Cordell Eminent Scholar Jay Ritter, who wrote a new paper, along with Minmo Gahng at the University of Florida and Donghang Zhang at the University of South Carolina, which found that stock-market investors in SPACs that merged with private companies since 2015 lost an average 37% of their investment a year after the merger through the end of September. At the same time, SPAC managers, known as sponsors, turned an average investment of about $8 million into about $54 million, giving them average annualized returns of 110% on their initial investment in the SPACs.

SPAC Sponsors Were Winners Even on Losers

The Wall Street Journal

While U.S. Labor Secretary Marty Walsh says it’s “hard to say” if there will be an impact on the unemployment rate in the coming months, Clinical Professor and Richardson Fellow Brian Gendreau shares that while short-term impacts can be devastating to impacted areas, in the long term, there’s typically an increase in construction activity, which can spur employment.

Labor Secretary: 'Hard to say' if Hurricane Ian will impact Florida's unemployment rate

Spectrum News

If any electrical grid could ever be hurricane-proof, it would probably be here in the Sunshine State. Director of Energy Studies Ted Kury shares his insights on how the Florida electric grid was made more resilient in previous years thanks to investment from the state’s utility companies.

Most Floridians got power back quickly after Ian. But for some the wait has just begun.

The Washington Post

Here & Now‘s Anthony Brooks speaks with Public Utility Research Center Director of Energy Studies Ted Kury about how, after a spate of storms in 2004 and 2005, Florida utilities learned to work together to make the electric grid more resilient, and what work can be done to avoid power failures next time there’s a big storm.

Florida's electric was made more resilient before latest storm

WBUR | Here & Now

The Los Angeles Times consulted two dozen researchers, financial planners and counselors, including Associate Dean for Research and Director of the Human Resource Research Center Mo Wang, about how to tell when you’re ready for retirement.

Think retirement is out of reach? Here’s what you need to know.

The Los Angeles Times

From the best of times, to the worst of times: The market for initial public offerings has fallen off a cliff in 2022. Investors faced with high inflation and rising interest rates have ditched high-flying growth stocks and turned to safer, more profitable alternatives. Cordell Eminent Scholar Jay Ritter shares his insights on how the IPO market went from boom to bust in 2022, and whether he expects a rebound in 2023.

The IPO market went from ‘boom to bust’ in 2022. Here’s what’s driving the massive slowdown.

CNBC

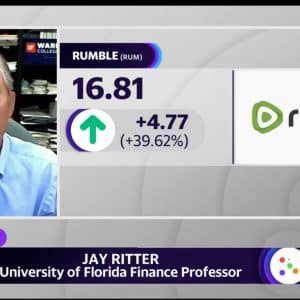

IPO expert and Cordell Eminent Scholar Jay Ritter joins Yahoo Finance Live to discuss the SPAC deal for the Peter Thiel-backed company Rumble, which has started trading on the stock exchange, and also weighs in on the Porsche and Instacart IPOs.

Trump-tied Truth Social’s ‘regulatory trouble’ may benefit Rumble’s IPO: Expert

Yahoo! Finance

According to Cordell Eminent Scholar Jay Ritter, Apple investors should not to worry because the sheer dollar amount of shares sold short is “pretty meaningless.” He added that he is not currently short Apple but is short Tesla.

Apple is now the market’s most shorted stock. If Tesla is an example, that’s bullish.

MarketWatch

Corebridge, the life and asset management business of insurance group AIG, went public this week with the help of 43 different banks, the second-highest number of managing underwriters for a US listing on record, according to data collected by the Cordell Eminent Scholar Jay Ritter.

Corebridge IPO shows appeal of crowd support for companies

Financial Times

The federal government is on a path to waste over $30 billion of the $65 billion it plans to spend over the next few years to expand broadband services throughout the nation. Public Utility Research Center Director and Gunter Professor Mark Jamison writes about what steps Florida can take to keep that waste from happening by assuming a leadership role among states determined that their citizens should receive all the broadband that they pay for.