Always risk on

How Steve Schnall’s focus on finding his next challenge led him to a career full of innovative business ventures, including his current role as Founder & CEO of Quontic Bank.

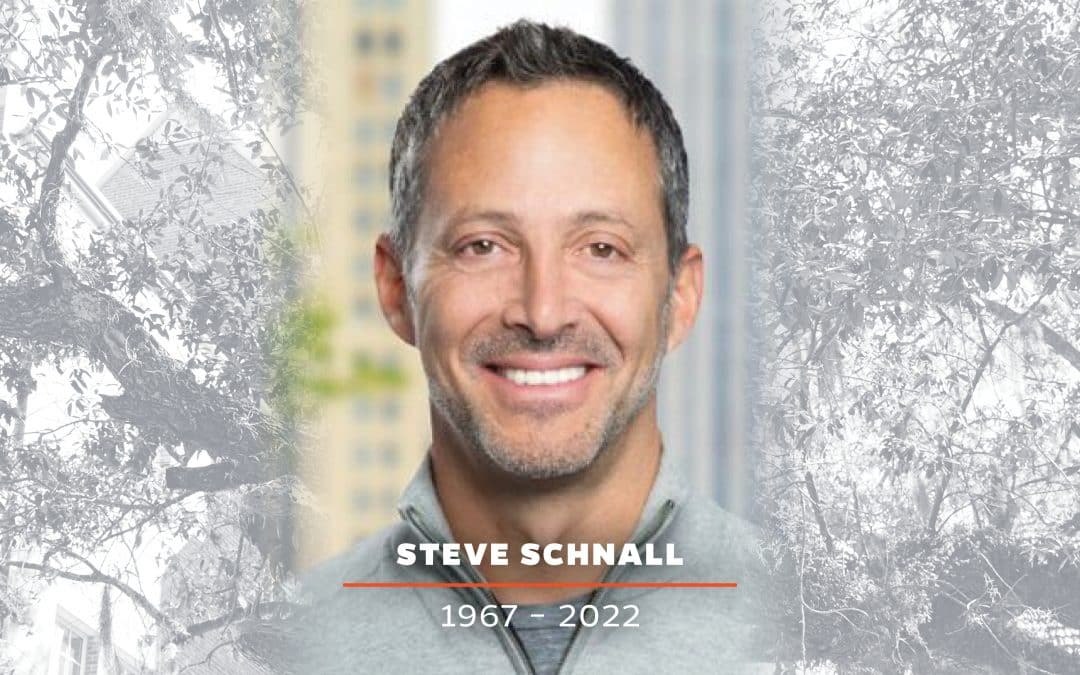

Editor’s note: Sadly, Steve Schnall unexpectedly passed on August 2, 2022. You can view his obituary in The New York Times.

From an early age, Steve Schnall (BSAc ’89) had to learn how to hustle. As one of two sons of a single mother, Schnall was always on the lookout for how he could support himself and his family. In fact, Schnall’s first job was inspired by the lack of peepholes on the doors of the Clearwater condominium community his family lived in at the time.

After his mother expressed interest in having a peephole installed on the family’s door, the idea was born in Schnall’s mind.

“My brother and I were the first in our family to go to college, and I knew I’d need to save some money in order to get there,” he said. “I thought, ‘If we want a peephole, then I bet everyone wants one,’ and all it really requires is drilling a hole through the door.”

Thanks to a friend who worked at a hardware store, Schnall was able to get peepholes at a wholesale price that he sold door-to-door in his condo community for $15.

“People would ask ‘Who is it?’ when we’d knock on their doors, and we’d reply, ‘If you had a peephole, you’d know!’” he recalled with a laugh.

That endeavor enabled Schnall to save a few thousand dollars, which would help him pay for his expenses as a freshman at the University of Florida. As an accounting student, Schnall learned the ins-and-outs of the financial side of business, which would serve him well in his career as a serial entrepreneur.

Like many accounting students, though, Schnall got his first job with one of the then-Big 8 accounting firms, PricewaterhouseCoopers. While Schnall’s initial goal was to attend law school after completing his undergraduate studies, the recession of the late 1980s and subsequent influx of law school applicants would put his first- and even second-choice schools out of reach.

Unsure at the time if law school would pan out, Schnall met with a PwC partner who was recruiting students at the Fisher School of Accounting. When the partner asked which office Schnall was interested in – Miami, Orlando, Tampa – Schnall gave him a surprising response – New York City.

“I wasn’t really serious about the job, but I did think it would be really cool to live in New York,” Schnall said. “The next day, I ended up getting a call to go to New York for an interview.”

Shortly after, Schnall was offered a role as an auditor in the PwC New York City office. With the $36,000 offer and no acceptances from his top choice law school selections, Schnall took the job. The very next day, he packed up his belongings and made the 15-plus hour drive to the city he’s called home ever since.

After about 10 months with the accounting firm, Schnall was looking to move on, and a search for a new apartment would lead to his next career path. Scanning the New York Times, Schnall found an apartment that seemed to fit his needs. However, he quickly found out that it was part of a scam in which the “landlords” would initially note the apartment was for rent, but trick people into buying the space for multiple times its real value.

After figuring out the scheme, Schnall went to discuss this with the men he had bought the apartment from. Recognizing Schnall’s astute grasp on business, they recruited him to start a separate mortgage company with them. Despite the mortgage company faring well, adding about 20 employees by the end of its first year, Schnall’s business partners’ true malicious colors came to light.

“They ended up taking everything from me,” Schnall recalled. “They left me destitute, jobless and in debt.”

With a $15,000 loan from a friend and the same hustle mentality Schnall had grown up with, he ultimately turned a bad situation into a profitable one. The initial loan and a decade of hard work would help Schnall create the New York Mortgage Trust, a publicly traded REIT with 65 offices in 25 states.

In 2004, Schnall took his company public and then in 2007, he sold New York Mortgage Trust just moments ahead of the impending credit crisis. After being semi-retired for about a year, he was ready for his next business opportunity. With the Great Recession in full swing, Schnall knew he wasn’t looking to go back into the mortgage business. Instead, he focused on another area he was interested in – banking.

Schnall found a Long Island bank that was failing, and after purchasing and rebranding it, Quontic Bank was born. Quontic is an adaptive digital bank that focuses on providing banking activities for the underbanked, from gig economy workers to small business owners to low-income families.

“I started going to bank conferences explaining my idea, and all the other bank CEOs said I should have my head examined,” Schnall said. “They told me that it was a terrible time for banks and that I had no experience, but I still thought it was a pretty good idea.”

As Quontic’s CEO, Schnall is especially proud of the bank’s designation as a Community Development Financial Institution (CDFI) by the U.S. Treasury Department. The CDFI designation means that Quontic offers tailored resources and innovative programs that generate economic growth and opportunities for financially underserved communities.

“Quontic’s first home was in Astoria, Queens, which is a very diverse neighborhood with many first-time homebuyers,” Schnall said. “We believe that homeownership is how people build wealth, so we were able to fill the lending gap for the underbanked and build a thriving credit side of Quontic.”

As a bank with no physical branches, the COVID-19 pandemic provided Quontic with many opportunities for innovation when other banks were transitioning to remote work. It was among the first banks to be completely digital as well as the first to launch a Bitcoin account option and a wearable ring that serves as a debit card.

Quontic’s focus on the underbanked and innovative digital banking technology has led it to be named Forbes’ Best Online Bank and Money’s Most Innovative Bank, two designations of which Schnall is particularly honored.

“Sometimes I get lost in how hard it is,” he said. “The regulatory experience is hard. I pinch myself sometimes when I think about where we came from to where we are today, and I have a lot of gratitude.”

Schnall credits the support of his team for getting the bank to where it is today.

“As an entrepreneur, I love startups and I tend to try to do everything myself,” Schnall said. “But you have to surround yourself with smart, talented people, and you can’t get there unless you pay for it. You have to spend a bit of money upfront to get to where you want to go.”

Schnall also notes that it’s not just the great team Quontic has, but the equally strong corporate culture.

“I love the phrase, ‘Culture eats strategy for breakfast,’” Schnall said. “If your employees don’t like their job, then it’s going to be hard to get them on board with what you’re trying to accomplish.”

Schnall’s years of experience have provided him with plenty of insights that he wishes he would have known in his early years as an entrepreneur. The biggest lesson he’s learned over time, he noted, is understanding the value of mentorship.

“I did things alone forever, and sometimes you meet people in life serendipitously that can help you, but you can’t be afraid to ask for help,” he said. “Still, even at 55 years old, I call people who I know I can rely on for help.”

In addition to New York Mortgage Trust and Quontic, Schnall has also had a hand in several other businesses. He founded Fit Athletic Club, a California-based luxury health and fitness chain, Realmor Capital, a real estate investment and development firm in NYC, and the early-stage dotcom Restaurant.com.

While Quontic is Schnall’s main focus for the time being, like any good business leader, he’s always looking ahead to what’s next.

For now, Schnall hasn’t out ruled the possibility of a business outside of the finance industry or even going into two other business areas he’s familiar with – health facilities or real estate development.

One thing that Schnall is forever focused on is his family, who he spends the majority of his time with outside of work. Schnall and his wife have two sons, one of whom is a rising sophomore at the Warrington College of Business.

Extending his love of adrenaline outside of the office, Schnall is also an avid motorcyclist and snowboarder. When he needs to wind down, though, Schnall picks up a book from the stacks he has in his home office.

“I read a lot,” he said. “I like non-fiction, things that share contrarian viewpoints as well as on cryptocurrency and AI. I’ve always been a bit of a futurist. It’s like Wayne Gretzky said, ‘I skate to where the puck is going, not where it has been.’”