Just a Thought – Office Market

Tuesday, September 29th was the date of the first virtual “State of the Sector” Roundtable of the Bergstrom Real Estate Center Advisory Board. It was also my first opportunity to attend this meeting, virtual or in-person. Moderator, Steve Cohen, elicited valuable market and sector comments from a long list of participants, and he guided an interesting discussion about the coming year’s real estate performance. I am very happy to have had the opportunity to join the group and look forward to these roundtables in the future.

NCREIF, an industry organization of institutional real estate investors, is holding an educational conference during which I will moderate a panel discussion about the office market. This reminded me of the discussion concerning the future of the office sector that took place during the roundtable. At the end of that meeting, Steve posed a broad paradigm question to the group. To paraphrase, he asked: Will the COVID-19 event that we are all experiencing right now cause a major paradigm shift in real estate usage, or is it a temporary impact that will allow usage to return to normal? Throughout the debate, there were compelling arguments made for significant sustained effects, and for only a temporary impact.

Without becoming too theoretical, all markets seek equilibrium. Of course, the features of equilibrium can change dramatically over time, particularly following a shock or technological breakthrough. Notwithstanding this last point, history has shown that equilibrium characteristics prior to a market event are commonly insignificantly changed, after the resolution of a shock. During the early 1990s, some pundits proclaimed that the US will never need another square foot of office space. In 2001, as the growing technology industry fell to its knees, many believed that we lost the last big office users. In those cases, and many others, the office sector recovered its balance and new supply was built.

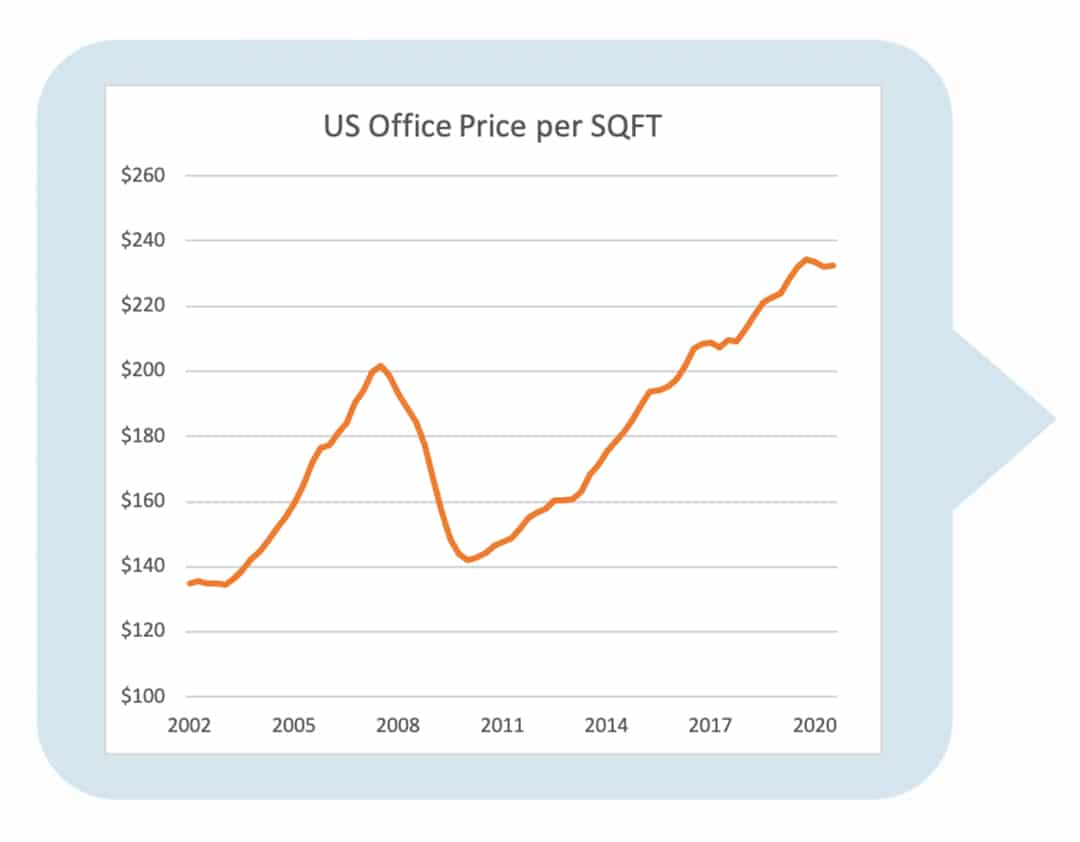

At the moment, there are at least two reasons to believe that the current downturn will be far less significant than the last. First, the previous recession developed economically. The world lost confidence in credit, which is the foundation for most investing. Second, uncertain conditions lasted for over two years. It took the office market 30 months to move from peak to trough. The pandemic resolution is still uncertain, but the magnitude of decline and the duration of concern may still be far less than during 2009.

Competition will drive market participants to the most effective state, once conditions normalize. Thus, the only way that the office market will be permanently altered will be with new technological development or fundamental loss of demand. The COVID-19 effect may take some participants completely out of the market and may eliminate the need for some set of buildings. However, competition will likely force the broad market participants back to the office, once the shock has passed.

Consider the recent evolution of the College Football season. As the summer passed, under the cloud of COVID-19, College Athletic Departments across the country were searching for a plan to hold the ‘20/’21 football season. The Big Ten Conference announced on August 11th that they would not play Division I Football during the fall and would consider the possibility of a spring season. At the time, everyone’s fall football season was uncertain. The Big Ten (as well as the PAC 12) took a stand to cancel fall ball for safety reasons. Other conferences delayed their decision and ultimately set schedules for the fall. Of the Power 5 Conferences, the ACC and Big 12 began playing on September 12th and the SEC was set to start their season on September 26th.

Highlights of the football season are The College Football Playoffs (CFP) and The National Championship Game. Once it became clear that some conferences would complete a fall season, discussions of a spring championship or split championship started to fade. The Big Ten discovered that postponing football until the spring would likely cost Ohio State an opportunity to play for the National Championship. On September 16th, the Big Ten announced that it reversed its decision and would hold an abbreviated schedule, starting October 24th and ending before the December 20th CFP deadline. The PAC 12 followed suit one week later.

Coming back to real estate, once the risks associated with the current coronavirus are muted by new medicine, some businesses will return to normal operations and normal office occupancy. Assuming last year’s occupancy was the product of operational efficiency and competitive forces, businesses that safely return to full usage of their office space will hold an advantage. Over time, competition will draw most companies back to this balance and thus office properties back to balanced occupancy.

Of course, there may be some long-term effects on office usage. If new technology is developed under this time of duress or if operators discover some new efficient set of operations that requires less space, office use may not fully recover. On the margin, some tenants will be forced out of the market by this shock and some new tenants may form due to these events. At the same time, planned construction will be affected by the 2020 events, altering the path of supply additions. It will take time for this economic shock to work through the real estate markets.

There is certainly some negative impact on office income and pricing, leading to current value loss. The level of this impact is a function of how the effects are shared between landlord and tenant, through existing leases. Over the coming few years, I am confident that the markets will again move toward equilibrium until we have a new challenge to face.