Warrington in the News Articles: page 24

It’s no secret that Warrington faculty are internationally renowned for their innovative research. The media looks to our scholars for insights and impactful news. See below where our faculty are featured in the news.

Director of Energy Studies Ted Kury explains how critical it is to make electric grids more resilient before the next big storm.

“A key consideration with a complicated system like the electricity grid is understanding the rights and responsibilities of all stakeholders — from service providers and customers to the government,” Kury writes.

As Puerto Rico recovers, we all need to ask how to make grids more resilient

The Hill

The tech firm wants to bring mainstream investors—and their advisors—into the IPO process, territory once reserved for favored clients, insiders and underwriters. But to take on Wall Street’s reliable revenue generator, many moving pieces will have to fall into place.

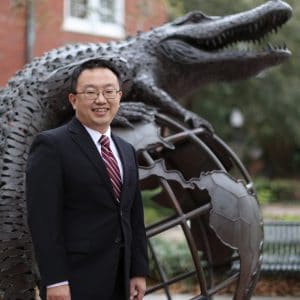

“Lots of people have complained for decades about how inefficient the process is for pricing and allocation in IPOs,” said Jay Ritter, Cordell Eminent Scholar, and a longtime researcher in the area of IPOs.

ClearingBid seeks to be the new way to IPO

WealthManagement.com

California has been generating the most initial public offerings of any US state every year since 2003. That streak could end this year unless the Golden State picks up the pace.

California’s change of fortune is explained largely by the drop in valuations among Silicon Valley’s tech startups, said Jay Ritter, Cordell Eminent Scholar. “It is almost entirely just a reset of valuations,” he said.

California Faces Loss of IPO Crown as Tech Startup Plans Stymied

Bloomberg

Money managers who oversaw blank-check companies kept making profits even in the face of significant losses to stock investors.

“There is no question that the sponsors had great returns at the same time that public market investors had very negative returns,” said Cordell Eminent Scholar Jay Ritter, who wrote a new paper, along with Minmo Gahng at the University of Florida and Donghang Zhang at the University of South Carolina, which found that stock-market investors in SPACs that merged with private companies since 2015 lost an average 37% of their investment a year after the merger through the end of September. At the same time, SPAC managers, known as sponsors, turned an average investment of about $8 million into about $54 million, giving them average annualized returns of 110% on their initial investment in the SPACs.

SPAC Sponsors Were Winners Even on Losers

The Wall Street Journal

While U.S. Labor Secretary Marty Walsh says it’s “hard to say” if there will be an impact on the unemployment rate in the coming months, Clinical Professor and Richardson Fellow Brian Gendreau shares that while short-term impacts can be devastating to impacted areas, in the long term, there’s typically an increase in construction activity, which can spur employment.

Labor Secretary: 'Hard to say' if Hurricane Ian will impact Florida's unemployment rate

Spectrum News

If any electrical grid could ever be hurricane-proof, it would probably be here in the Sunshine State. Director of Energy Studies Ted Kury shares his insights on how the Florida electric grid was made more resilient in previous years thanks to investment from the state’s utility companies.

Most Floridians got power back quickly after Ian. But for some the wait has just begun.

The Washington Post

Here & Now‘s Anthony Brooks speaks with Public Utility Research Center Director of Energy Studies Ted Kury about how, after a spate of storms in 2004 and 2005, Florida utilities learned to work together to make the electric grid more resilient, and what work can be done to avoid power failures next time there’s a big storm.

Florida's electric was made more resilient before latest storm

WBUR | Here & Now

The Los Angeles Times consulted two dozen researchers, financial planners and counselors, including Associate Dean for Research and Director of the Human Resource Research Center Mo Wang, about how to tell when you’re ready for retirement.

Think retirement is out of reach? Here’s what you need to know.

The Los Angeles Times

From the best of times, to the worst of times: The market for initial public offerings has fallen off a cliff in 2022. Investors faced with high inflation and rising interest rates have ditched high-flying growth stocks and turned to safer, more profitable alternatives. Cordell Eminent Scholar Jay Ritter shares his insights on how the IPO market went from boom to bust in 2022, and whether he expects a rebound in 2023.

The IPO market went from ‘boom to bust’ in 2022. Here’s what’s driving the massive slowdown.

CNBC

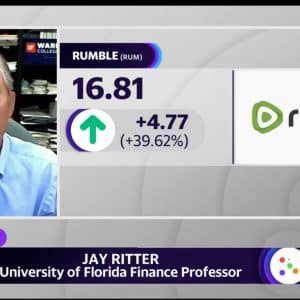

IPO expert and Cordell Eminent Scholar Jay Ritter joins Yahoo Finance Live to discuss the SPAC deal for the Peter Thiel-backed company Rumble, which has started trading on the stock exchange, and also weighs in on the Porsche and Instacart IPOs.