Warrington in the News Articles: page 32

It’s no secret that Warrington faculty are internationally renowned for their innovative research. The media looks to our scholars for insights and impactful news. See below where our faculty are featured in the news.

Here & Now‘s Anthony Brooks speaks with Public Utility Research Center Director of Energy Studies Ted Kury about how, after a spate of storms in 2004 and 2005, Florida utilities learned to work together to make the electric grid more resilient, and what work can be done to avoid power failures next time there’s a big storm.

Florida's electric was made more resilient before latest storm

WBUR | Here & Now

The Los Angeles Times consulted two dozen researchers, financial planners and counselors, including Associate Dean for Research and Director of the Human Resource Research Center Mo Wang, about how to tell when you’re ready for retirement.

Think retirement is out of reach? Here’s what you need to know.

The Los Angeles Times

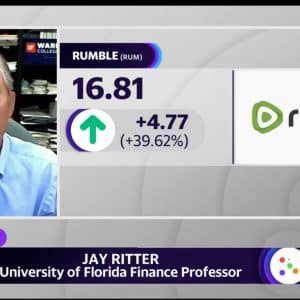

From the best of times, to the worst of times: The market for initial public offerings has fallen off a cliff in 2022. Investors faced with high inflation and rising interest rates have ditched high-flying growth stocks and turned to safer, more profitable alternatives. Cordell Eminent Scholar Jay Ritter shares his insights on how the IPO market went from boom to bust in 2022, and whether he expects a rebound in 2023.

The IPO market went from ‘boom to bust’ in 2022. Here’s what’s driving the massive slowdown.

CNBC

IPO expert and Cordell Eminent Scholar Jay Ritter joins Yahoo Finance Live to discuss the SPAC deal for the Peter Thiel-backed company Rumble, which has started trading on the stock exchange, and also weighs in on the Porsche and Instacart IPOs.

Trump-tied Truth Social’s ‘regulatory trouble’ may benefit Rumble’s IPO: Expert

Yahoo! Finance

According to Cordell Eminent Scholar Jay Ritter, Apple investors should not to worry because the sheer dollar amount of shares sold short is “pretty meaningless.” He added that he is not currently short Apple but is short Tesla.

Apple is now the market’s most shorted stock. If Tesla is an example, that’s bullish.

MarketWatch

Corebridge, the life and asset management business of insurance group AIG, went public this week with the help of 43 different banks, the second-highest number of managing underwriters for a US listing on record, according to data collected by the Cordell Eminent Scholar Jay Ritter.

Corebridge IPO shows appeal of crowd support for companies

Financial Times

The federal government is on a path to waste over $30 billion of the $65 billion it plans to spend over the next few years to expand broadband services throughout the nation. Public Utility Research Center Director and Gunter Professor Mark Jamison writes about what steps Florida can take to keep that waste from happening by assuming a leadership role among states determined that their citizens should receive all the broadband that they pay for.

Here’s why Florida should provide broadband leadership

Tallahassee Democrat

The SPAC boom is officially a thing of the past.

“I think that was a once-in-a-lifetime experience just like during the internet bubble,” said Cordell Eminent Scholar Jay Ritter. “A year ago, the whole market was overpaying and now we have a reset. Giving a valuation of $500 million on a zero revenue company … those days are gone.”

SPAC market hits a wall as issuance dries up and valuation bubble bursts

CNBC

Sometimes, says Cordell Eminent Scholar Jay Ritter, rather than cutting back on big purchases during periods of high inflation, we actually end up spending more. In a way, he says, we’re trying to “lock in” prices now on these long-desired items.

I’ve Never Been an Impulse Buyer—Until Now

The Wall Street Journal

While diminishing these U.S. companies and making them and their customers more vulnerable to foreign manipulation, the legislation would likely leave state-affected Chinese and Russian technology platforms untouched, argues Mark Jamison, Public Utility Research Center Director and Gunter Professor.