Why retailers sell generic brand items, despite low sales

GAINESVILLE, Fla. – Search ‘women’s tops’ on Amazon, and the online retail giant will yield more than 100,000 results. Some of the brands will likely be familiar – Nike, Hanes, Calvin Klein – but there are also a number of brands that don’t have the same name recognition.

Many of these brands are generics made by retailers like Amazon. In fact, Amazon offers 66 clothing sub-brands in its lineup of private labels, but such generic brands account for only 1% of all store brand sales.

While it may appear that companies like Amazon are simply trying to provide consumers with options, new research from the University of Florida Warrington College of Business notes that there is a reason companies offer what are called ‘decoy products’ amongst their lineup of options.

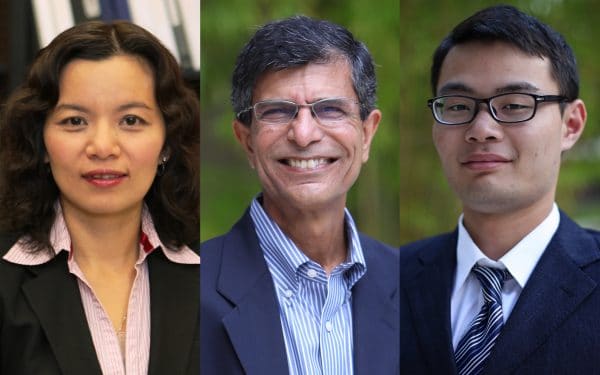

Associate Professor Amy Pan, McClatchy Professor Asoo Vakharia and alumnus Quan Zheng.

Associate Professor Amy Pan, McClatchy Professor Asoo Vakharia and Quan Zheng (Ph.D. ’18) of the University of Science and Technology of China find that retailers include decoy products from high-cost manufacturers (like Amazon’s generic brands) in an assortment of options from low-cost manufacturers (like name-brand items) because it helps companies obtain better contractual terms from active low-cost manufacturers.

“The retailer offers a decoy product alongside active products with the rationale being that by including such a product, the retailer can impose a negative externality on the active lower cost manufacturers,” the researchers explain in their paper “Product Decoys: A Supply Chain Perspective.”

In doing so, in a balanced market that includes a decoy product, low-cost manufacturers are forced to both compete for market share and cooperate to ensure that the high-cost manufacturer of the decoy product doesn’t receive order quantities that allow the high-cost manufacturer to gain sales.

“Thus, the retailer’s inclusion of a decoy induces a form of co-opetition behavior among manufacturers,” the researchers note.

For low-cost manufacturers that ignore the actions of the decoy-product manufacturer, the researchers warn that despite the gains they might make from higher prices, they would lose market share.

While the decoy-product manufacturer would benefit from increased competition with low-cost manufacturers, it could incur fixed costs. If the manufacturer were to have such costs, Zheng, Pan and Vakharia recommend that the retailer evaluate whether including the decoy is actually viable by trading off profits from including the decoy versus the cost of including the low-cost manufacturer offering the decoy in the supplier set.

“Essentially, this bestows on the retailer an opportunity to gain additional profit if the fixed cost of including a supplier is lower,” the researchers explain.

This research is featured in Production and Operations Management.