As a surgeon in the United States Air Force, Lt. Col. Andrew Hall (MBA ’24) understands how critical of a resource blood is to treat combat casualties. As part of his work with the United States Central Command (USCENTCOM), Lt.

Faculty & Research: page 23

Read the latest news and research from University of Florida Warrington College of Business faculty, who are thought leaders in their respective fields and provide expert guidance in the classroom. Their research provides industry leaders and individuals with insights they can use in their careers and daily lives.

Management faculty named 2024 UF Research Foundation Professor

GAINESVILLE, Fla. – Klodiana Lanaj, Martin L. Schaffel Professor in the Department of Management, is among the 34 University of Florida professors honored as the most productive and promising faculty named UF Research Foundation (UFRF) Professors for 2024. The recognition

These Couples Survived a Lot. Then Came Retirement.

Research from Mo Wang, Associate Dean, Lanzillotti-McKethan Eminent Scholar and retirement expert, informs this story about life after work bringing an unexpected set of challenges for many relationships. Read more in this story from The New York Times Magazine.

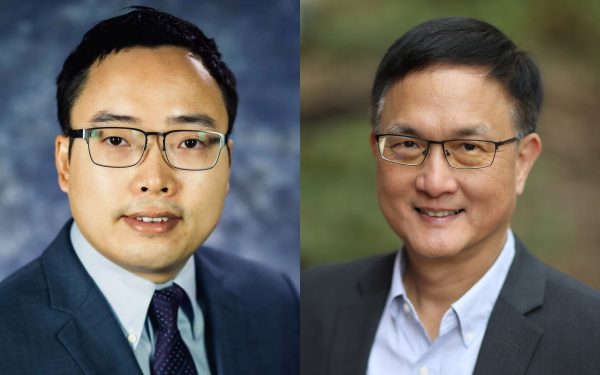

Research by Warrington faculty receives Antitrust Writing Award

GAINESVILLE, Fla. – Assistant Professor Jingchuan Pu and John B. Higdon Eminent Scholar Chair Hsing Kenneth Cheng’s paper has been awarded this year’s Antitrust Writing Award. After receiving its nomination at the beginning of the year, Pu and Cheng’s paper,

9 must-read leadership books for business professionals

Want to progress your leadership skills? Check out recommendations from University of Florida Warrington College of Business faculty and staff. Glue: How Project Leaders Create Cohesive, Engaged, High-Performing Teams By Anh Dao Pham “This book is a hidden gem for

Algorithms powering John Ruiz’s company being probed by SEC, Justice Department

When attorney John H. Ruiz took his company public in 2022, the Miami entrepreneur promised that its software algorithms were so effective they could spot billions of dollars in improperly paid health-insurance claims that would eventually yield significant profits for

Social Entrepreneurship Lecturer honored with awards for teaching and service

Social Entrepreneurship Lecturer in Management Kristin Joys is this year’s recipient of both the B Academics Instructor of the Year Award and the University of Florida Presidential Service & Leadership Faculty/Staff Advocate of the Year Award. B Academics annually recognizes

Real estate education benefits at the University of Florida with David Ling

David Ling, Ken and Linda McGurn Professor and Director of the Nathan S. Collier Master of Science Real Estate program at UF Warrington, joins Michael Bull of America’s Commercial Real Estate Show to discuss the benefits of a real estate

University of Florida management professor awarded for significant scholarly achievement by premier organization

GAINESVILLE, Fla. – Klodiana Lanaj, Martin L. Schaffel Professor, is the latest recipient of the Academy of Management Organizational Behavior Division’s Cummings Early to Mid-Career Scholarly Achievement Award, which recognizes scholarly achievement of an early- to mid-career scholar. Lanaj is

UF Warrington management department No. 1 in productivity per faculty fourth year in a row

GAINESVILLE, Fla. – For four consecutive years, the 13 tenure-track faculty members of the Department of Management at the University of Florida Warrington College of Business have affirmed their authority as top-tier researchers. As in 2020, 2021 and 2022, Warrington’s