Want to maximize your mutual fund investment returns? Find a portfolio manager with ‘skin in the game’

GAINESVILLE, Fla. – If you’re one of the 56 million Americans who invests in mutual funds, making sure that your portfolio is yielding the best returns is paramount. While your portfolio manager should technically always be looking out for your best interests, how can you be sure that they are going to make the best decisions regarding your investment? One simple way, according to new research, is to find a portfolio manager who invests their own money into the fund they manage.

Yuehua Tang

Specifically, mutual fund portfolio managers who invest their own money into the fund they manage tend to be less risky than portfolio managers who do not invest in the fund they manage, according to research from Warrington College of Business Assistant Professor Yuehua Tang and Linlin Ma of Peking University. More simply, finding a portfolio manager with ‘skin in the game’ is beneficial for you as an investor.

While vetting portfolio managers might sound like a lot of work, Tang and Ma suggest its easier than you might expect. Since 2005, the U.S. Securities and Exchange Commission has required mutual funds to disclose portfolio managers’ ownership stakes in the fund. Using this information, Tang and Ma collected data on portfolio manager ownership of 1,610 actively managed U.S. domestic equity mutual funds from 2007-2014.

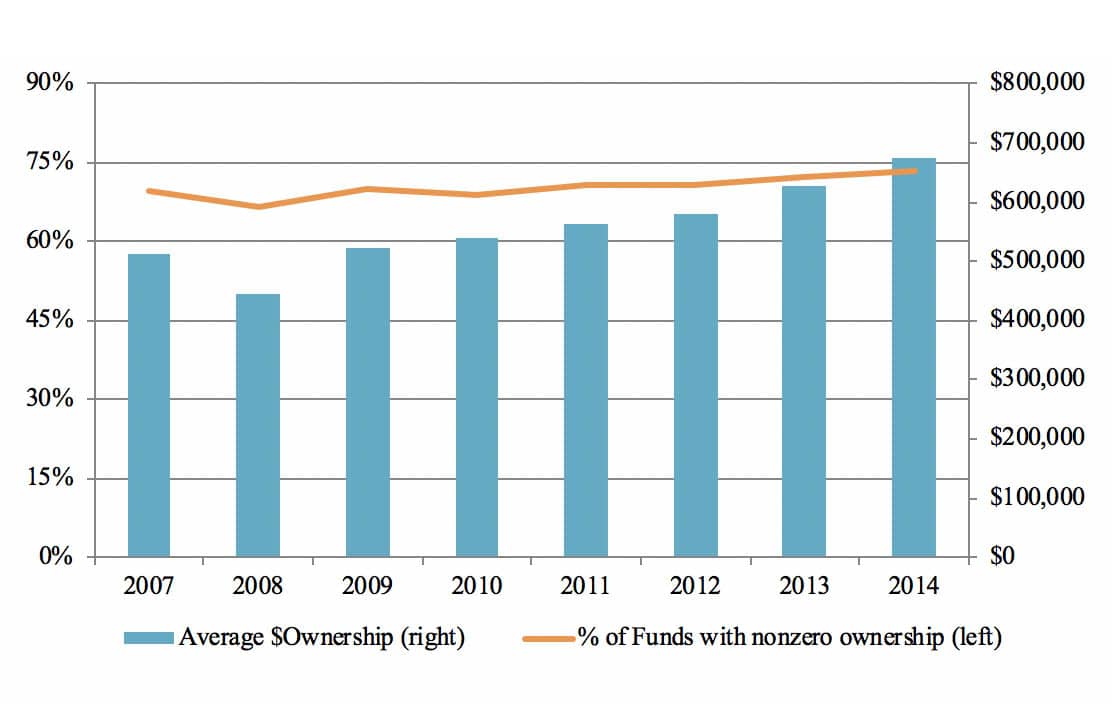

“We find that about 70 percent of our funds sampled have at least one portfolio manager co-investing in the fund, with an average stake of about $540,000,” Tang and Ma write.

Analyzing mutual funds’ portfolio rebalancing behavior, Tang and Ma constructed measures that capture managers’ intended changes in portfolio risk. They found that both intra-year and across-year risk change measures decrease as managerial ownership increases. Meaning, “portfolio managers with greater ownership stakes in their funds, ceteris paribus, are associated with greater reduction of risk taking in the subsequent period,” they write.

Figure 1. Yearly Distribution of Portfolio Manager Ownership.

Note: This figure presents the fraction of funds with positive portfolio manager ownership (Ownership Dummy = 1, left axis) and average dollar amount of portfolio manager ownership ($Ownership, right axis) across different years.

Tang and Ma also found that the effect of ownership on risk reduction is particularly strong among portfolio managers with high agency issue-induced risk-taking incentives, like managers who face a more convex flow-performance relation, have poor performance, or are not compensated based on long-term fund performance by the fund management company.

“All these findings suggest that the main mechanism of ownership’s impact on risk reduction is through mitigating managers’ agency-induced risk-taking behavior,” the researchers write.

While the mutual fund industry has been shown to have excessive amounts of risk-taking among portfolio managers, Tang and Ma suggest that the best way to make sure your portfolio continues to produce the returns you desire is to find a manager that invests in the fund they manage. They suggest that having ‘skin in the game’ isn’t just something that benefits investors, but also something that funds should strongly encourage, if not require.