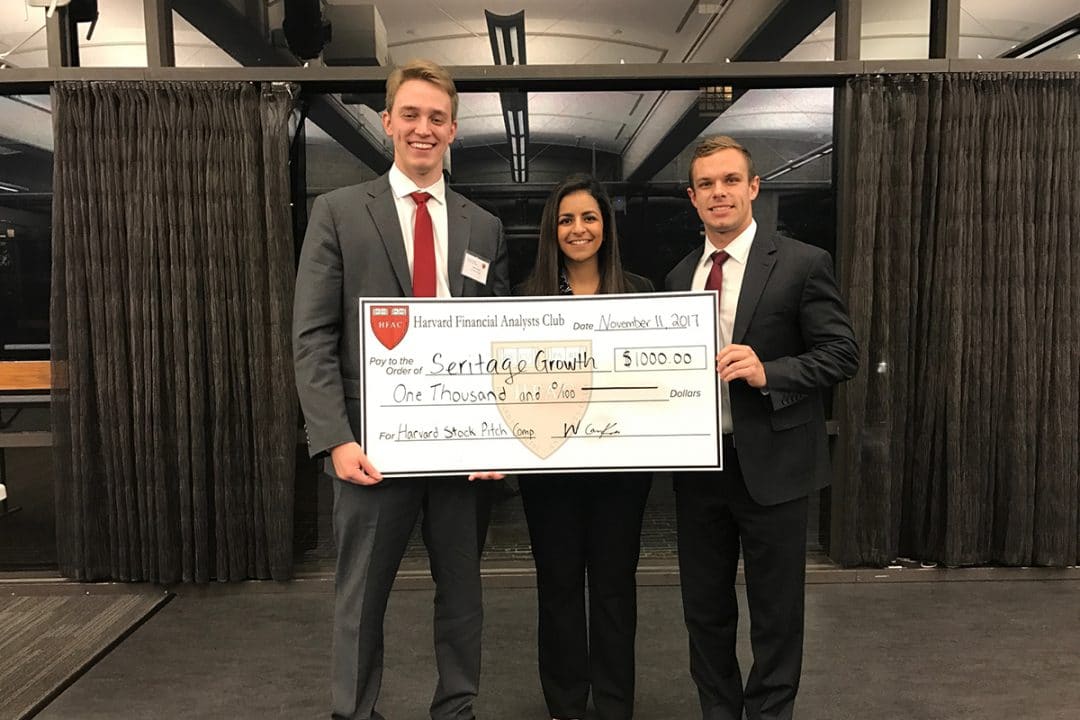

MSF team wins stock pitch competition at Harvard

A team of Master of Science in Finance students won the Harvard University Stock Pitch Competition on November 10. The trio of James Goyer, Kristen Mousa and Paul Stanley came out victorious from the field of over 45 teams, representing schools such as Harvard, Columbia, Brown, Cornell, NYU, University of Pennsylvania, University of Waterloo, University of Southern California, University of Texas Austin, University of Wisconsin, McGill University and University of Virginia.

From the field, 18 teams advanced to the semifinals and two advanced to the final round. The University of Florida team defeated the University of Waterloo team in the finals.

It was the fourth stock pitch competition win for the team of MSF students. They previously won at the University of Georgia and Ohio State University, and they defeated 27 of the most respected business schools in the country at the ENGAGE® Undergraduate Investment Conference at the University of Michigan’s Ross School of Business.

Mousa shared some of her experience at the event and what the team went through on its way to victory.

Q: Why did you choose to focus on Seritage Growth Properties?

A: “Seritage Growth Properties is a premier retail real estate investment trust (REIT) that was spun off from the retailer Sears in 2015. Most of Seritage’s properties are still leased to Sears, and because of the unique master lease agreement structured between the two companies, Sears has been able to lease the properties at rates well below prevailing market rental rates. Our presentation was centered around the idea that, through a clause in the master lease agreement, Seritage can recapture these properties from Sears over time and re-lease them at market rates that are 4x higher.”

Q: What was the team’s preparation for the competition as you created your pitch?

A: “Over the last few months, we have spent a significant amount of time preparing for the competition. We first went through a stage of rigorous research and analysis to ensure that the idea was compelling. After compiling the necessary data, performing the valuation, and building the presentation, we spent 1-2 hours per day practicing verbal delivery of the pitch in front of students and faculty. This iterative process allowed us to refine our presentation and delivery in the weeks leading up to the competition, and it helped us stand out among other teams during the semifinal and final rounds.”

Q: What were some of the biggest challenges with the pitch?

A: “After getting a grip on the REIT industry and the company itself, one of our biggest challenges was synthesizing the information in a way that could be concisely communicated in a 12-minute pitch. Seritage has a unique opportunity to create value in a weakening retail environment, and it took time for us decide which pieces of information were most necessary and compelling to demonstrate that point to our audience.”

Q: What feedback did you receive from the judges about your presentation?

A: “One of the judges was Nori Lietz, who was rated as one of the 10 most prominent women in real estate in 2010. Ms. Lietz asked us some interesting and challenging questions due to her background in the real estate industry. She really pushed us to build on our knowledge and analysis of the company we were pitching, and going through that exercise will surely help us in future presentations both at UF and in our careers.

“We also had the opportunity to grab dinner after the competition with several of the judges. It was a great experience to meet industry leaders from such a wide range of buy-side roles and hear about what they did to prepare for their careers. We recently learned that a few of the judges have taken long positions in Seritage, and we are excited to have played a role in bringing the idea to the table!”